Work when you’re young, save up and have fun when you retire. This is how one is supposed to live their life according to the conventional American script.

The script is stupid.

You may not even live to retirement. You can enjoy your life now, travel now, have experiences now and also in retirement. But in order to live now and in retirement successfully, you have to be smart with your money. Being smart with your money isn’t easy. Financial literacy is not taught, and much of what is taught (or assumed) is just wrong. The commonly employed strategy of "just hoping it all works out" is a bad strategy.

The news is distressing. Half of people near retirement have no savings. Seventy percent of millennials have less than $5,000 in savings, and over half have less than $1,000 (including, incredibly, 28.6% that make over $150,000 a year!). People are not saving. They are going to have to work full time their entire lives or live at a much lower standard of living then they are accustomed to. This doesn't have to be you.

Earning a high income helps but is not a requirement for financial freedom (in fact, earning a high income actually does not matter if you cannot manage your money correctly - there are plenty of lottery winners, ex-sports stars, etc. who have made millions and are now bankrupt due to poor financial planning).

Is this advice out of place on a travel blog? No. For us, smart financial planning is what enables our lifestyle now and will enable it in the future.

So here it is, my financial lessons learned and advice distilled into a single article. This advice is not all-encompassing nor wholly original. In fact, it could be considered a re-telling of the Bogleheads investment philosophy (named after Vanguard founder and index-fund advocate Jack Bogle). This is a strategy that is endorsed by Warren Buffet among others, and what I settled on after heavily researching the topic in books and online and having practiced it myself over the last several years.

This document is heavily slanted to United States citizens (especially with respect to retirement accounts and Social Security) but many of the principles are universal.

Disclaimer: As with all financial and investment advice, you should be skeptical. Do your own independent research before taking any steps with your own money (there are plenty of external references linked in this post). I am not responsible for any use or mis-use of this information. This is what works for me and I believe it can work for others too, but ultimately you alone are responsible for your finances and what you do with them. I also don't cover important topics in depth like mortgages, inflation, withdrawal rates in retirement, life insurance, disability insurance, annuities, and other topics that you should familiarize yourself with. This advice is meant to apply to most of the general population; those with significant resources or money may wish to hire tax advisers or even financial consultants after properly educating themselves, but buyer beware, as there is no shortage of people willing to separate you from your money, and many financial consultants are no smarter than you are, they just charge more.

Really short version:

- Decide what to be and go be it

- Don’t overpay for college and avoid long term student loans

- Pay off all debt

- Live within your means

- Establish a 6-month emergency fund

- If possible, make use of tax advantaged retirement accounts

- If possible, make use of a taxable investment account

- Invest in low-fee index funds

- Invest in multiple asset classes (stocks and bonds), and pick an asset allocation that you can emotionally tolerate and makes sense for your time horizon

- Don’t fiddle, let your investments and compound interest do the work for you

Part I – Decide What To Be and Go Be It

This is actually the most important part before you do anything else. What do you want your life to look like now and in the future? What makes you happy? What gives you fulfillment? When do you (and/or your spouse) want to retire? How much money do you need to maintain a lifestyle now and in retirement? What are you going to do when you are retired? Travel? Work part time? Volunteer?

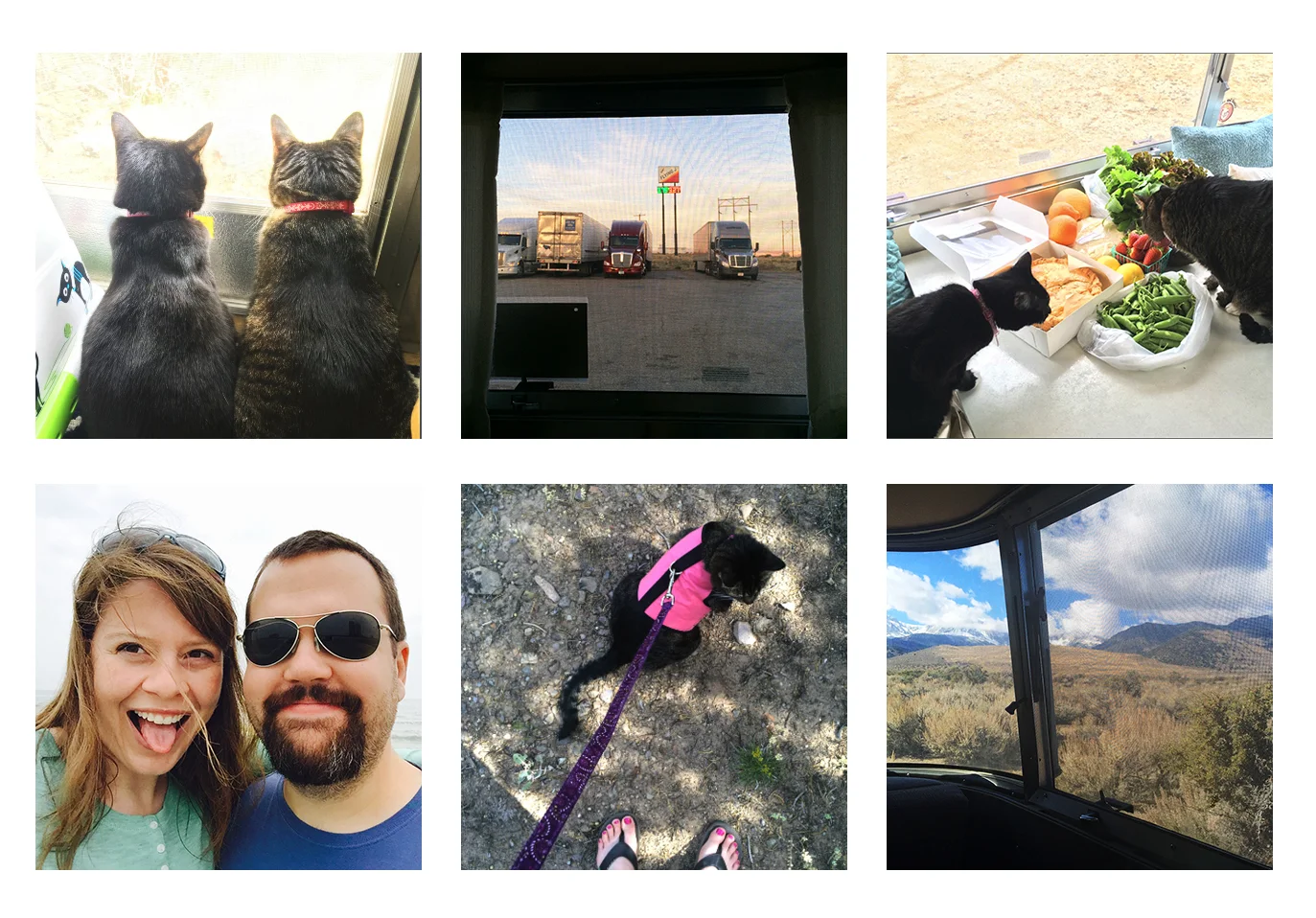

For Sarah and I, we value experiences in nature, travel, photography, our cats, food, quoting the Avett Brothers in blog posts, and generally having a good time with ourselves and friends and family. We don’t value (or value less) cutting edge camera or computer gear, expensive clothes, new cars, alcohol, TV sets, appliances, etc. We want to actively travel and photograph now, before retirement, and we want to save enough to retire before our 60s, though we anticipate we will always make some income from photography.

Most of the financial advice here is applicable for any scenario, but the actual amounts you choose to save and invest versus spend now are completely dependent on your goals and lifestyle. While you do not have to have all the answers at this point, having a general plan and an idea of where you want to be is important. I also understand that not everyone has the means or capability to execute this entire plan, especially not immediately, and that's OK. Everyone has to start somewhere, and removing your debt and living within your means is a good place to start. After that you can start saving money and investing.

After thinking through the strategies discussed in this post and doing some reading on your own, it can be helpful to pull together a plan with some specific short-term strategies (for example: pay off credit cards in the next two years, start an investment account and invest $5,000 over the next year, and maximize employer contributions for retirement) and longer-term goals (live debt-free, consistently reduce expenses and invest more to help make early retirement realistic, and pay off the mortgage in 7 years). And as an essential step, consider how to align (or re-align) your personal priorities with your financial goals to make sure that your habits and practices are deliberately focused on the things that are most important to you.

Part II – Laying the Foundation

College is great, massive debt isn’t

Most colleges are the same. Sure there are the Ivy League schools, Stanford, Carnegie-Mellon, Cal-Tech, MIT and a handful of others that stand out in the US, but with rare exception, few college educations are worth going into severe debt. This is especially true if you are entering a medium or low-income profession.

It is better to go to an affordable college than being saddled with debt that takes you years (or even a decade) to crawl out of.

I am absolutely in favor of higher education, but not at any cost. The college of your dreams is probably too expensive, so unless you get a scholarship, skip it, and find a good public local college instead. Pay as much as you can while you attend. Student loans are horrible and are creating a new "debtor class" in the United States.

Is that post-graduate degree worth it? Probably not. I don't mean to ruin your dreams, but run the numbers before you're in over your head.

Some of you may be in over your head already because you already have massive college debt, but don't give up because your situation feels overwhelming. With discipline, a plan, and some time, you can get to a much better financial situation.

Remove Debt First and live within your means

The largest key to financial flexibility is being debt free. This means absolutely no long-term student loans and no credit card interest. Using credit cards is a good idea if you are disciplined, as they are convenient, have fraud protection, and you can earn points and actually save money. But the moment you start paying credit card interest, they become a bad idea. If you use credit cards, commit to paying them off every month, automatically. Buy a car out of necessity but not out of want. If your car is reliable, keep it.

To be debt free means you have to earn more or equal than what you spend. That’s the only way the math works. It’s often easier to reduce expenses than it is to increase income. Be smart and deliberate with your purchases. If it helps you, establish a budget and follow through with it. Live within your means or below your means. Resist short-term gratification, and wait before making any large purchases to make sure you are making them for rational, not emotional, reasons.

There are some tools you can use to pay off your debt. One common method is the Debt-snowball method and another is simply paying the highest interest debt first. Find a method that works for you and stick with it. It may take years but it will be worth it. You will establish financial discipline, learn to budget, and give yourself the ability to save in the future.

Taking on debt for a mortgage can be OK (and even beneficial, especially if you stay well within your means and are not constrained by your monthly payment), but for other purchases, think long and hard before you buy things you cannot immediately afford.

Compound Interest is Amazing

The reason to save money and the reason to avoid debt is the same: compound interest is amazing. Exponential growth is great for your savings, and absolutely devastating for your debt.

The concept of compound interest is simple (when your interest becomes part of your principal and gains interest itself, thus literally compounding your interest), but the actual effects of it are hard to appreciate without an example.

If you start with $5,000 principal, and gain 7% interest a year (approximately the average return of the US stock market over the past 10 years), then you will double your money approximately every 10 years. So after 10 years you will have $10,000, in 20 years you’ll be at $20,000, in 30 years you’ll be at $40,000. That’s a net profit of $35,000 for doing nothing for 30 years!

If you had only normal interest that did not compound (in other words, it never got added back to the principal), you would make $350 ($5,000 * 7%) a year, over 30 years that's $10,500, which is $25,000 less than with compound interest. Compounding interest makes an enormous difference and its effect cannot be overstated. If you want to play with the numbers, there are plenty of compound interest calculators out available online.

Considering the effect of inflation is important, as well. Historically, inflation in the US has been about two to three percent per year. This means after about 20 to 30 years, your money will have exactly half of its purchasing power - yikes! This is a good reason to start saving and investing as early as you can.

Start saving as early as you can

Compound interest is amazing but it needs some time to really work its magic, the earlier you start saving, the better. Do not put saving off! Let the math of compound interest work for you.

The easiest way to save is to have payments automatically deduct from your paycheck or bank account (by your employer for an employer sponsored retirement account like a 401(k), or by your investment company or bank). You are much less likely to notice the absence of money when it is handled automatically.

Create an emergency fund

An emergency fund is a liquid account (such as a low-risk savings account) that can cover your full living expenses during an emergency period (such as a sudden loss of employment, extended unpaid sick leave, a car accident where you are responsible, or similar). Having an emergency fund will insulate you from accumulating debt from short term borrowing (or worse: from cashing out your retirement accounts) in the event of an emergency.

An emergency fund should cover 6 months of income (some people say less, some say more). This money should be treated as untouchable, and only used in an emergency (getting a new TV is not an emergency).

Use tax-advantaged retirement accounts

In the US, employer sponsored pensions are rare. Rare too is the employee that remains at a single company long enough for a pension to be substantial. In the place of employer sponsored pensions are tax-advantaged retirement accounts, including pre-tax accounts (401(k)s, 403(b)s, traditional IRAs) and post-tax retirement accounts (Roth IRAs). These accounts all have penalties if you withdraw before retirement age, and they all have maximum annual contribution limits, but the tax advantages make them worthwhile.

With a pre-tax account, such as a 401(k) or a traditional IRA, you pay tax on earnings when you withdraw, but not when you contribute. If you make $50,000 a year, and contribute $5,000 to your 401(k), your income tax that year will be on $45,000. Most employers also provide some match on 401(k) contributions. This is free money for you so take advantage of it to help grow your retirement savings.

With a post-tax account, such as a Roth IRA, you are taxed before you put the money in the account, but not taxed when you withdraw. If you earn $50,000 a year and put $5,000 in an IRA, you will still be taxed for $50,000 but any interest in your Roth IRA grows tax-free. Roth IRA’s have income limits (which can be subverted via a so-called backdoor Roth IRA in some instances) and also a lower contribution limit than a 401(k).

All things being equal, a Roth is often a better option (no taxes on exponential growth is a fantastic deal). A traditional strategy is to max out your 401(k)/403(b) up to the employer contribution, put the remaining money in a Roth until you max out the annual Roth contribution, and then put the rest back into your 401(k)/403(b) and max it out. If there is any money left over, you can put into savings or a taxable investment account.

There are lots of rules and regulations on tax advantaged retirements accounts, so I suggest the Bogleheads wiki for more information on income limits, contribution limits, required minimum distributions, and backdoor Roth IRAs. The bottom line is that it makes sense to use these tools as much as you can.

Many employer 401(k) plans are limited in the mutual funds you can choose, but you can usually find a few low-fee index funds (see below).

Money left over? Use a taxable investment account

So you have no debt, an adequate emergency fund, and have maxed out your tax-advantaged retirement accounts - what's next?

After patting yourself on the back, you could consider opening a taxable investment account, where you can invest in stocks, bonds, or other securities (index mutual funds are best, see below section). This taxable account, unlike a tax-advantaged retirement account like a 401(k), can be accessed at any time. You will however have to pay capital gains tax on your profits (if the assets you sell are less than a year old, that will be equal to your income tax rate, if the assets you sell are older than a year, it’s lower, usually 15% or 20% depending on your income). If you lose money, you can take advantage of tax-loss harvesting and actually reduce your taxes (this is an advanced topic, see the Bogleheads wiki for more information).

You could throw it all into a savings account, but the interest rate on savings account is much less than you can get with a typical stock/bond portfolio and will not outpace inflation.

Instead of investing a lump some of money all at once, it makes sense to divide that lump sum into smaller amounts that are invested over time. For example, if you have $6,000 sitting in a savings account that you want to invest, you could invest $500 every month for a year, vs. investing $6,000 right now. With this approach, you are less likely to be impacted by unlucky timing (for example, the market could take a sharp downward turn immediately after you invest your lump sum). This technique of spreading a lump sum out over a period of time is known as dollar cost averaging.

It is also OK to create a taxable investment account without first maximizing your retirement account if you wish to retire early, but do the math and make a solid, realistic plan first (factoring in tax savings, early withdrawal penalties, and capital gains taxes, among other things).

Don’t count on Social Security

Will Social Security be around when you retire? Hopefully! For those retiring soon it is a safer bet than those like me who have to wait 25 years or more before they reach Social Security age. Trying to predict the political climate that far in advance is impossible. For younger people creating a financial plan, it is probably safer to assume it will not be there.

Part III – How to Invest

If you have a tax-advantaged retirement account (such as a 401(k)) or a taxable investment account, you need to decide how to invest that money. Should you invest in stocks, bonds, treasury bills, real estate? How much in each? Foreign or domestic? What types of mutual funds?

It seems complicated but it doesn’t have to be.

Diversification, asset allocation, and risk tolerance

It’s common sense that if you invest in, say stocks, having a diverse selection stocks mitigates risk. The easiest way to buy a collection of stocks is via a mutual fund (or an ETF). There are mutual funds of all shapes and sizes, small sector, large sector, foreign, domestic, technology, medical, and so on. The same options exist for bonds. You can buy mutual funds that cover a wide spectrum of bonds (corporate bonds, municipal bonds, treasury bonds, all that mature at different times), which is less risky than cherry-picking a small handful of bonds on your own.

Speaking of risk, not all assets have the same risk. Stocks are riskier than bonds, they will (over time) have a higher rate of return but also have a higher potential for negative returns during bear markets. Bonds are less risky and more stable but have a lower rate of return. Treasury bills are less risky still.

Stocks, bonds, and treasury bills are all different asset classes, and they each possess a different amount of risk. The specific ratio of asset classes in your entire portfolio is known as your asset allocation. By choosing the proportion of stocks to bonds to treasury bills to real estate to other asset classes, you can control the relative risk and expected rate of return of your portfolio (see the Bogleheads wiki on risk and return for more information on how risk and expected return are correlated). By diversifying within a specific asset class, you mitigate risk of that asset class.

Why not just throw everything in stocks and get the highest rate of (expected) return? Not all investors (I might even say most) have the emotional capacity to tolerate losses and volatility common in stock heavy portfolios (especially in bear markets). If your asset allocation has you nervous and consistently worried, or even worse, causes you to panic and sell all of it for cash, then it is too risky for you. Your ability to tolerate a specific asset allocation is known as your risk tolerance. Everyone is different, but the key is to know what you’re comfortable with.

Your time horizon is another essential consideration. If you are retiring soon or need your investments for reliable income, it’s better to have a conservative (more bond heavy) asset allocation. If you are retiring in 30 years or investing to save up for a purchase in the more distant future, a more aggressive asset allocation can make sense depending on your risk tolerance. Either way, you have to be comfortable with your approach and make sure that your investment strategy matches the timeline for your life. (If you are new to investing, learning about your risk tolerance can be a good first step.)

Index funds, fees, and passive investing

So you know you should use mutual funds and invest in a few different asset classes.

Which mutual funds should you choose?

First, there are a few good qualities to look for in mutual funds:

- Low fees. Fees are predictable and known in advance. Returns are not predictable. Just like it makes sense to pay of your debt first, it make sense to minimize any fees in your mutual funds first. You may think that a difference of 1% in fees is inconsequential but you could not be more wrong. Fees can reduce returns significantly. Here is an example.

- Low risk, relative to their asset class

- Good returns

There is one class of mutual funds that meet all these criteria: index funds.

An index fund is a fund that tracks a specific index, such as the S&P 500. They are low cost because the management of them is relatively straightforward; they simply buy stocks in the proportion to match the index they are tracking, and do not need to pay managers who attempt to pick stocks. A total market index fund, such as Vanguard’s Total Stock Market Index Fund (VTSMX) essentially owns every US stock in proportion to its market capitalization. Total bond index funds, such as Vanguard’s Total Bond Market Index Fund (VBMFX) proportionally invests in corporate and government bonds of all maturities.

Buying a total stock market index fund is basically buying a piece of the entire US stock market. If the market goes up, which has always done historically over time, the value of the fund will increase. That performance in addition to their low fees makes total stock market index funds very attractive.

Compare total market index funds to managed funds, whose managers (often charging high fees) attempt to choose a subset of the market that they think will outperform the rest. Sometimes they do, sometimes they don’t, but over time, index funds historically perform better than an averaged managed fund, even ignoring fees. It may seem counterintuitive that a "dumb index fund" can perform better than a managed fund by a "market expert", but the numbers don't lie. If you are curious why, I highly recommend reading A Random Walk Down Wall Street by Burton Malkiel. Basic math says that about half of professional money managers are below average (or in this case, below the average returns of an index fund) - so why pay for below average when you can get above average for lower fees?

The other advantage of index funds is that they support passive investing. You can buy the fund and then forget about it. You will minimize transaction fees in addition to management fees. You don’t have to try and be a market expert and time the highs and lows. The easiest way to invest is to just buy a portfolio of index funds (one or more funds for each asset class), or an all-in-one fund like Vanguard's LifeStrategy funds.

Once you decide on your asset allocation, you buy your funds and then, and this is key, you leave them alone. Don't fiddle. You are not trying to time the market, you are counting on the long-term health of the US economy to do the work for you. Once a year you may want to rebalance your portfolio (for example, if you had a 60% stock and 40% bond asset allocation, and at the end of the year it was 65% stock and 35% bonds, you may wish to buy more bonds, or exchange stocks for bonds, to keep the 60/40 ratio going). This is called rebalancing.

But my friend bought Apple stock in 2001 and is doing really well!

Good for your friend! For every Apple there thousands and thousands of non-Apples (Apple’s market capitalization has increased much faster than the US GDP, which means that there have to be some losers in there to balance it out). Anecdotal results after the fact are not an investment strategy. Day-traders may extoll their successes but rarely talk about their failures, and they have to fail all the time in order for all the ones who succeed to succeed. Besides, you probably have more important things to do than watch the stock market all day long.

I understand the temptation to pick stocks – it’s fun. But let’s call it really what it is: educated gambling (sometimes uneducated gambling!) If you cannot resist the temptation to pick stocks I would suggest you set aside a separate account (let's call it your "gambling account") that you use to pick and choose stocks or mutual funds. Leave your retirement and other investment accounts alone. Unless you are dedicated to becoming an expert on investing and willing to spend a great deal of time actively managing your money for a chance at slightly higher return, index funds are the best solution for most people.

Where to invest?

I highly recommend Vanguard, as they have the lowest fees and a corporate structure that is in line with their investor's values and not at odds with them. They also have a great selection of index funds, including LifeStrategy funds where you pick a single fund that has a pre-determined asset allocation (80% stocks/20% bonds for the Growth fund, or 60% stocks/40% bonds for the Moderate Growth fund, etc.). Under the fancy names, these funds are actually four-fund portfolios (total domestic stock index fund, total international stock index fund, total domestic bond fund, total international bond fund), a well-diversified option that can be a good place to start for new investors. Once you select a fund and a have a plan, using automatic investments makes things easy and consistent.

If you have a 401(k)/403(b), you will likely be stuck with whatever company your employer chooses (the good news is you can roll that employer 401(k) over to a traditional IRA at Vanguard when you leave if you wish). My employer uses Fidelity, which is a decent second option to Vanguard.

Regardless of where you choose to invest your money, make sure that the fees are low and that the company supports your values.

Conclusion

Making good financial decisions is not something you should put off. Financial management isn't fun, it isn't sexy, but it is important. It doesn't have to be hard. Ignore the cacophony of so-called financial experts on TV and in the media who have a personal advantage in making things seem more complicated than they actually are. A passive and consistent investment strategy will allow you to concentrate on enjoying life and not paying undue attention to the stock market, all while making good returns in the process.

The sooner you start making plans and stop making excuses the better. Be active and deliberate in your decisions, not passive and reactive. And, as discussed in the Vanguard investing principles document linked below, make a plan and stick with it over time. There is a lot in life that you cannot control or plan for, but that's no excuse to ignore the parts in life you can control.

I would recommend following up on many of the links in this post, checking out Vanguard's principles for investing success, and also looking at the Bogleheads Wiki and forum for more resources.